Introduction

Tariffs have long been a key tool in U.S. trade policy, but the recent wave of new or increased U.S. tariffs in 2025 is sending ripple effects across the global economy. From China and India to the European Union and Latin America, countries are now reassessing their trade strategies as the world’s largest economy recalibrates its import rules.

This article explores how U.S. tariffs are impacting global economies, sector-specific challenges, and how nations are reacting diplomatically and economically.

What Are U.S. Tariffs?

Tariffs are taxes imposed by a country on imported goods. In 2025, the U.S. government has expanded or introduced new tariffs on a wide array of products, including:

- Electronics

- Steel and aluminum

- Textiles

- EV batteries and semiconductors

- Pharmaceuticals

- Agricultural commodities

These tariffs are largely aimed at protecting domestic manufacturing, addressing trade imbalances, and countering geopolitical concerns—especially with countries like China and Russia.

Global Impact: Country-by-Country Breakdown

U.S. tariffs have far-reaching consequences, disrupting supply chains, inflating prices, and reshaping trade alliances. Below is a country-wise look at how nations across the globe have been affected:

Turkey

- Mainly Affected Sectors: Steel, aluminum.

- Impact:

- Tariffs doubled during a diplomatic dispute in 2018.

- Currency value plunged as economic tensions escalated.

- Trade normalized later, but the economy faced lasting impacts.

South Korea

- Mainly Affected Sectors: Steel and automobiles.

- Impact:

- Negotiated to avoid most tariffs under the revised U.S.-Korea Free Trade Agreement.

- Increased investment in U.S. auto plants to offset tariff risks.

United Kingdom

- Mainly Affected Sectors: Whiskey, luxury goods, aerospace.

- Impact:

- Hit during Boeing-Airbus dispute with U.S. retaliatory tariffs.

- Aimed to strike its own trade deal with the U.S. post-Brexit.

Brazil

- Mainly Affected Sectors: Steel and agriculture.

- Impact:

- Received quota-based exemptions on some steel products.

- Benefited from U.S.-China trade tensions as China bought more Brazilian soybeans.

Vietnam

- Mainly Affected Sectors: Electronics, textiles, footwear.

- Impact:

- Benefited as U.S. companies moved manufacturing out of China.

- Surged to become a top exporter to the U.S.

- Under scrutiny for potentially serving as a conduit for Chinese goods to bypass tariffs.

India

- Mainly Affected Sectors: Steel, aluminum, textiles, and pharmaceuticals.

- Impact:

- Lost GSP (Generalized System of Preferences) benefits in 2019, affecting $5.6B in exports.

- Imposed retaliatory tariffs on almonds, walnuts, apples, and other U.S. goods.

- Recently in talks for a mini trade deal amid looming new tariffs under the Trump 2.0 policies.

Japan

- Mainly Affected Sectors: Automobiles, electronics, steel.

- Impact:

- Avoided some tariffs after direct negotiations with the U.S.

- Signed a limited bilateral trade agreement with the U.S. in 2019.

- Tariffs prompted strategic investments in U.S.-based manufacturing plants.

Germany

- Mainly Affected Sectors: Automobiles and machinery.

- Impact:

- German auto industry faced looming threats of tariffs that caused stock market jitters.

- Diversified exports to non-U.S. markets and strengthened EU internal trade.

Canada

- Mainly Affected Sectors: Aluminum, steel, lumber.

- Impact:

- Faced steep tariffs under Section 232 (national security provision).

- Retaliated with their own tariffs on U.S. goods, including whiskey and ketchup.

- Resolved after renegotiations under USMCA, but still cautious about trade policy shifts.

Mexico

- Mainly Affected Sectors: Auto parts, agriculture, and steel.

- Impact:

- Temporary threats of tariffs over immigration concerns created instability.

- U.S. companies near-shored operations to Mexico, somewhat boosting the Mexican economy.

- NAFTA’s replacement (USMCA) added new rules for manufacturing and digital trade.

China

- Mainly Affected Sectors: Electronics, machinery, steel, and consumer goods.

- Impact:

- Exports to the U.S. declined sharply after the 2018 trade war escalated.

- Chinese manufacturers faced increased costs and lost U.S. market share.

- Some companies shifted operations to Southeast Asia to bypass tariffs.

Global Ripple Effects

- Supply Chain Shifts: Many multinational companies realigned their supply chains, especially moving away from China to Vietnam, Mexico, and India.

- Inflation Pressure: U.S. importers often passed tariff costs to consumers, contributing to higher global inflation in sectors like tech, food, and vehicles.

- Retaliatory Tariffs: Many countries retaliated with their own tariffs on American products, affecting farmers and manufacturers.

- Global Trade Realignment: U.S. tariff policies spurred regional agreements like RCEP and reinforced the EU’s push for independent trade strategies.

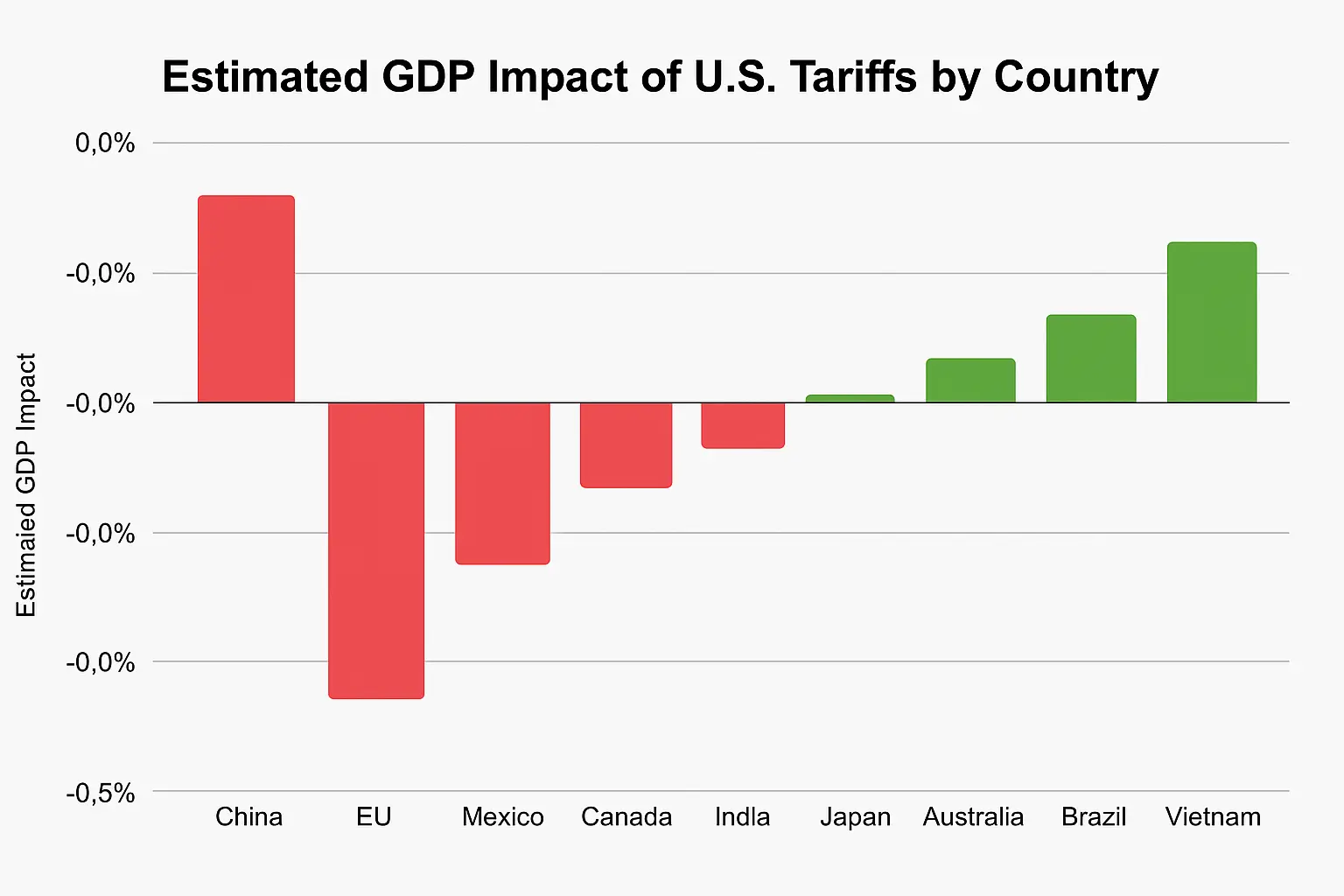

Global Economic Impact of U.S. Tariffs (Country-by-Country)

| Country | Estimated GDP Impact (%) | Key Affected Sectors | Source |

|---|---|---|---|

| China | -0.3% to -0.5% | Electronics, Steel, Consumer Goods | IMF, Peterson Institute for International Economics (PIIE) |

| European Union | -0.1% to -0.2% | Automobiles, Machinery, Agriculture | European Commission, WTO |

| Mexico | -0.1% | Automotive, Agriculture | Brookings Institution |

| Canada | -0.05% | Aluminum, Steel, Lumber | Statistics Canada, PIIE |

| India | -0.05% | Textiles, Metals, Pharmaceuticals | Ministry of Commerce, Indian Express |

| Japan | -0.08% | Automobiles, Electronics | World Bank, Nikkei Asia |

| South Korea | -0.07% | Semiconductors, Cars | Korea Institute for International Economic Policy |

| Australia | Negligible | Mining, Agriculture | Australian Government Reports |

| Brazil | Slightly Positive | Agriculture (export substitution) | IMF, Reuters |

| Vietnam | +0.1% to +0.3% | Electronics, Apparel (trade diversion) | HSBC, Bloomberg |

| United States | -0.2% to -0.4% | Manufacturing, Agriculture, Retail | U.S. Congressional Budget Office (CBO), USTR |

Sources Referenced:

- International Monetary Fund (IMF) – imf.org

- Peterson Institute for International Economics (PIIE) – piie.com

- World Trade Organization (WTO) – wto.org

- European Commission Reports

- Brookings Institution

- U.S. Congressional Budget Office (CBO) – cbo.gov

- HSBC Reports and Bloomberg (Vietnam data)

- Reuters, Nikkei Asia, and Korea Institute for International Economic Policy